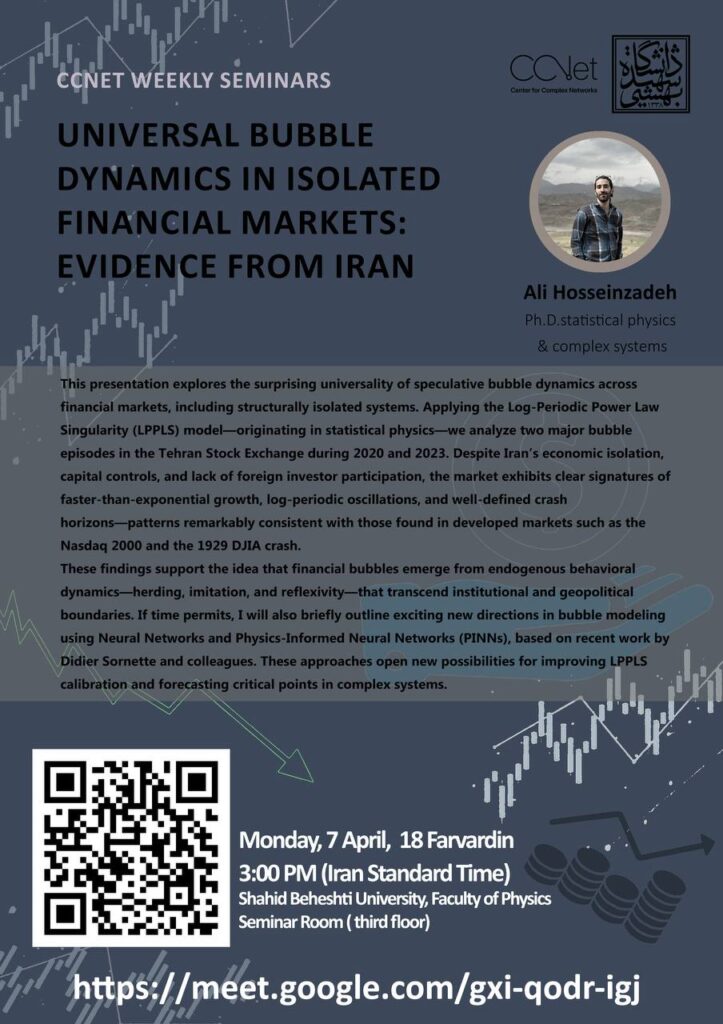

This presentation explores the surprising universality of speculative bubble dynamics across financial markets, including structurally isolated systems. Applying the Log-Periodic Power Law Singularity (LPPLS) model—originating in statistical physics—we analyze two major bubble episodes in the Tehran Stock Exchange during 2020 and 2023. Despite Iran’s economic isolation, capital controls, and lack of foreign investor participation, the market exhibits clear signatures of faster-than-exponential growth, log-periodic oscillations, and well-defined crash horizons—patterns remarkably consistent with those found in developed markets such as the Nasdaq 2000 and the 1929 DJIA crash.

These findings support the idea that financial bubbles emerge from endogenous behavioral dynamics—herding, imitation, and reflexivity—that transcend institutional and geopolitical boundaries. If time permits, I will also briefly outline exciting new directions in bubble modeling using Neural Networks and Physics-Informed Neural Networks (PINNs), based on recent work by Didier Sornette and colleagues. These approaches open new possibilities for improving LPPLS calibration and forecasting critical points in complex systems.